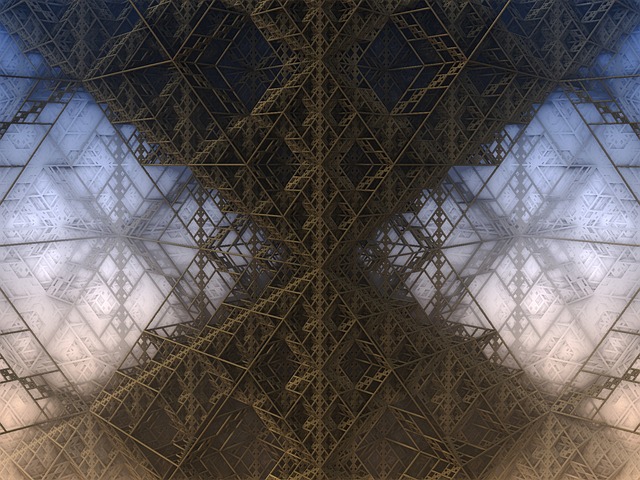

Amazon: Fractal Machine

B ezos understands compounding better than anyone, possibly even Buffett and Munger. Amazon is beyond a compounding machine; it is a fractal compounding machine. Every dollar it produces, it puts into taking more risks and spreads itself out at both the smallest and largest scales. Here is a smattering of recent stories that hint at this picture:

- Lindzon … Bezos could not have forseen today’s Amazon? Maybe, maybe not.

- Recode … It’s always Day 1 in Seattle.

- NY Times … Amazon keeps its bets small,

- VentureBeat … and keeps tinkering until it gets something the customer loves.

From FractalFoundation.org‘s homepage:

Fractals are infinitely complex patterns that are self-similar across different scales.

Breaking Away

I would say Amazon qualifies — underlying its growth is a repeating self-similar pattern! Bezos definitely understands that pattern.

This is not a recommendation to buy Amazon stock. Amazon stock is not without considerable risk! AMZN suffered a 65% peak-to-valley loss from 2008 to 2009 and has seen several 30% peak-to-valley losses since then. You or your advisor need to determine if Amazon is suitable.